Stock Market Outlook for August 1, 2023

Over the past 20 years, the S&P 500 Index has gained 0.1%, on average, during the month of August and 60% of periods have produced a positive result.

*** Stocks highlighted are for information purposes only and should not be considered as advice to purchase or to sell mentioned securities. As always, the use of technical and fundamental analysis is encouraged in order to fine tune entry and exit points to average seasonal trends.

Stocks Entering Period of Seasonal Strength Today:

Subscribers – Click on the relevant link to view the full profile. Not a subscriber? Signup here.

Polo Ralph Lauren Corp. (NYSE:RL) Seasonal Chart

Best Buy Co, Inc. (NYSE:BBY) Seasonal Chart

Blackrock, Inc. (NYSE:BLK) Seasonal Chart

Douglas Dynamics Inc. (NYSE:PLOW) Seasonal Chart

21Vianet Group Inc. (NASD:VNET) Seasonal Chart

CSW Industrials, Inc. (NASD:CSWI) Seasonal Chart

Aurora Cannabis Inc. (NASD:ACB) Seasonal Chart

The Markets

Stocks closed marginally higher on Monday as investors squared away positions ahead of the end of July. The S&P 500 Index squeezed out a gain of just over one-tenth of one percent in the final minutes of the session in typical window dressing fashion. Price continues to hover in the range of Thursday’s bearish engulfing candlestick, which highlighted hesitation among investors to buy around our proposed summer rally target of 4600. The divergence with respect to MACD attests to the same waning upside momentum at these heights. Support remains persistent at the rising 20-day moving average, now at 4508, and moving averages continue to fan out in a bullish manner, providing many points of reference below to catch the market should volatility in fact materialize as per seasonal norms in August and September. As profiled in the real-time seasonal charts at the bottom of this report for the S&P 500 Index and the TSX Composite, the trend of the equity market into the month of October is nothing to be enticed by to be aggressive in stocks and caution is typically the order of the day, particularly if there are no catalysts behind stocks to drive prices higher.

Today, in our Market Outlook to subscribers, we discuss the following:

- Monthly look at the large-cap benchmark

- Average performance for the S&P 500 Index during the month of August

- Our weekly chart books update: Find out what joins our Accumulate list this week

- Stocks that have either gained or lost in every August over their trading history

Subscribers can look for this report in their inbox or by clicking on the following link and logging in: Market Outlook for August 1

Not signed up yet? Subscribe now to receive full access to all of the research and analysis that we publish.

Want to know which areas of the market to buy or sell? Our Weekly Chart Books have just been updated, providing a clear Accumulate, Avoid, or Neutral rating for currencies, cryptocurrencies, commodities, broad markets, and subsectors/industries of the market. Subscribers can login and click on the relevant links to access.

- Currencies

- Cryptocurrencies

- Commodities

- Major Benchmarks

- Sub-sectors / Industries

- ETFs: Bonds | Commodities | Equity Markets | Industries | Sectors

Subscribe now.

Just released…

Our monthly report for August is out, providing you with everything that you need to know for the month(s) ahead.

Highlights in this report include:

- Equity market tendencies in the month of August

- On the lookout for signs of complacency ahead of the normal period of volatility for stocks

- Prepare the volatility hedges

- Breakdown of the dollar providing a bullish backdrop for precious metals

- Bonds

- It is about to become more difficult to alleviate measures of year-over-year inflation

- The end of the SPR withdrawal presents upside risks to the price of oil (and inflation generally)

- Weakest June change in Industrial Production in decades

- Defense remaining strong

- Building a portfolio with construction companies

- Shipping activity still looks dreadful

- Strong consumer offsetting weak business activity

- Ongoing manufacturer pessimism highlighting persistent strains in the business economy

- Above average change in jobless claims indicative of growing strains in the labor market

- High-yield spread finally below the lows of March

- The tightening of the Fed’s balance sheet remains ongoing

- Natural Gas

- Defensive shift emerging

- Finding quality in the Dow for the period of equity market volatility

- Emerging markets a viable play to escape volatility in developed markets

- Our list of all segments of the market to either Accumulate or Avoid, along with relevant ETFs

- Positioning for the months ahead

- Sector Reviews and Ratings

- Stocks that have Frequently Gained in the Month of August

- Notable Stocks and ETFs Entering their Period of Strength in August

Look for this 105-page report in your inbox or via the report archive.

Not subscribed yet? Sign up to our service now to receive this report and all of the research that we publish highlighting seasonal, technical, and fundamental setups in the economy and the market.

With the new month upon us and as we celebrate the release of our monthly report for August, today we release our screen of all of the stocks that have gained in every August over their trading history. While we at Equity Clock focus on a three-pronged approach (seasonal, technical, and fundamental analysis) to gain exposure to areas of the market that typically perform well over intermediate (2 to 6 months) timeframes, we know that stocks that have a 100% frequency of success for a particular month is generally of interest to those pursuing a seasonal investment strategy. Below are the results:

And how about those securities that have never gained in this eighth month of the year, here they are:

*Note: None of the results highlighted above have the 20 years of data that we like to see in order to accurately gauge the annual recurring, seasonal influences impacting an investment, therefore the reliability of the results should be questioned. We present the above list as an example of how our downloadable spreadsheet available to yearly subscribers can be filtered.

Sentiment on Monday, as gauged by the put-call ratio, ended bullish at 0.87.

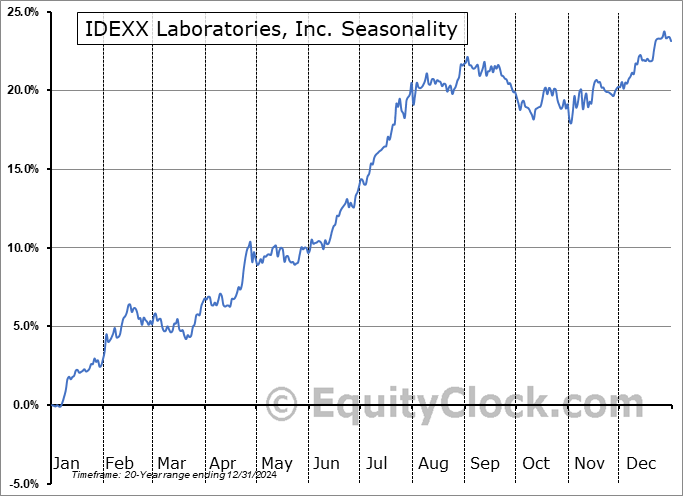

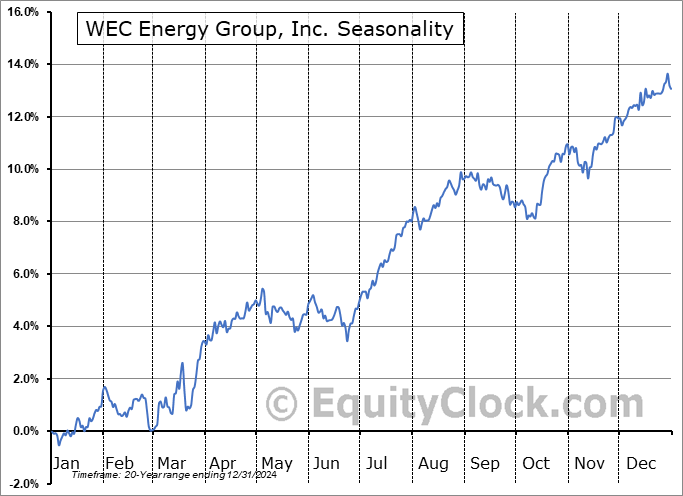

Seasonal charts of companies reporting earnings today:

S&P 500 Index

TSE Composite

| Sponsored By... |

|