Stock Market Outlook for July 31, 2023

The economy continues to have a service side tilt as goods producing industries struggle, something that is apparent in both the US and Canada.

*** Stocks highlighted are for information purposes only and should not be considered as advice to purchase or to sell mentioned securities. As always, the use of technical and fundamental analysis is encouraged in order to fine tune entry and exit points to average seasonal trends.

Stocks Entering Period of Seasonal Strength Today:

Subscribers – Click on the relevant link to view the full profile. Not a subscriber? Signup here.

Garmin Ltd. (NYSE:GRMN) Seasonal Chart

Old Republic Intl Corp. (NYSE:ORI) Seasonal Chart

Choice Hotels Intl, Inc. (NYSE:CHH) Seasonal Chart

BMO India Equity Index ETF (TSE:ZID.TO) Seasonal Chart

Gen Digital Inc. (NASD:GEN) Seasonal Chart

Titan Mining Corp. (TSE:TI.TO) Seasonal Chart

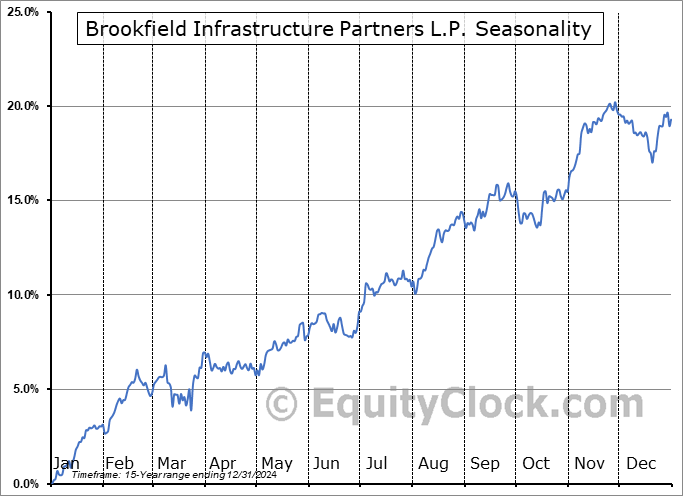

Brookfield Infrastructure Partners L.P. (TSE:BIP/UN.TO) Seasonal Chart

The Markets

Stocks snapped back to close the week as investors reacted positively to ongoing signs that inflationary pressures in the economy are moderating. The S&P 500 Index closed higher by just short of one percent, trading within the range of the prior session’s reversal range that highlighted upside buying exhaustion. Momentum indicators continue to show signs of rolling over with MACD remaining on a sell signal that was triggered on Thursday. The momentum indicator has been diverging from the direction of price for over a month, indicating waning buying demand around these heights. Support remains firm below at the rising 20-day moving average, a check-back of which is likely as the market enters its period of normal volatility through the months ahead. The summer rally period through the month of July has certainly been impressive, but it is time to step back, at least temporarily, to allow the price action to rest and reset.

Today, in our Market Outlook to subscribers, we discuss the following:

- Weekly look at the large-cap benchmark

- US Durable Goods Orders

- Canada Gross Domestic Product (GDP)

Subscribers can look for this report in their inbox or by clicking on the following link and logging in: Market Outlook for July 31

Not signed up yet? Subscribe now to receive full access to all of the research and analysis that we publish.

Just released…

Our monthly report for August is out, providing you with everything that you need to know for the month(s) ahead.

Highlights in this report include:

- Equity market tendencies in the month of August

- On the lookout for signs of complacency ahead of the normal period of volatility for stocks

- Prepare the volatility hedges

- Breakdown of the dollar providing a bullish backdrop for precious metals

- Bonds

- It is about to become more difficult to alleviate measures of year-over-year inflation

- The end of the SPR withdrawal presents upside risks to the price of oil (and inflation generally)

- Weakest June change in Industrial Production in decades

- Defense remaining strong

- Building a portfolio with construction companies

- Shipping activity still looks dreadful

- Strong consumer offsetting weak business activity

- Ongoing manufacturer pessimism highlighting persistent strains in the business economy

- Above average change in jobless claims indicative of growing strains in the labor market

- High-yield spread finally below the lows of March

- The tightening of the Fed’s balance sheet remains ongoing

- Natural Gas

- Defensive shift emerging

- Finding quality in the Dow for the period of equity market volatility

- Emerging markets a viable play to escape volatility in developed markets

- Our list of all segments of the market to either Accumulate or Avoid, along with relevant ETFs

- Positioning for the months ahead

- Sector Reviews and Ratings

- Stocks that have Frequently Gained in the Month of August

- Notable Stocks and ETFs Entering their Period of Strength in August

Look for this 105-page report in your inbox.

Not subscribed yet? Sign up to our service now to receive this report and all of the research that we publish highlighting seasonal, technical, and fundamental setups in the economy and the market.

Sentiment on Friday, as gauged by the put-call ratio, ended bullish at 0.88.

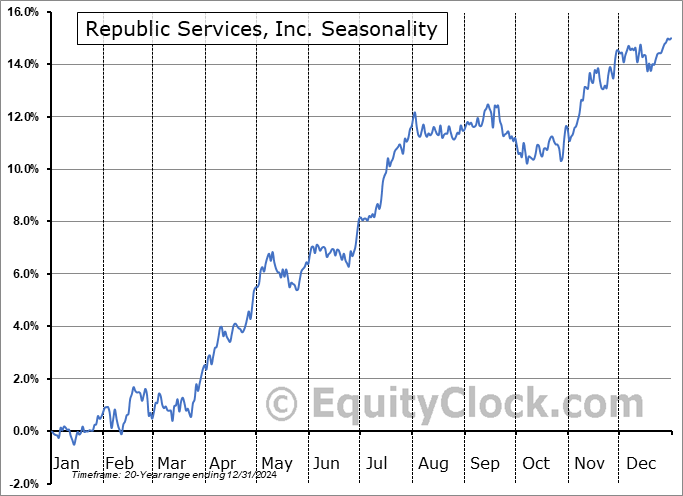

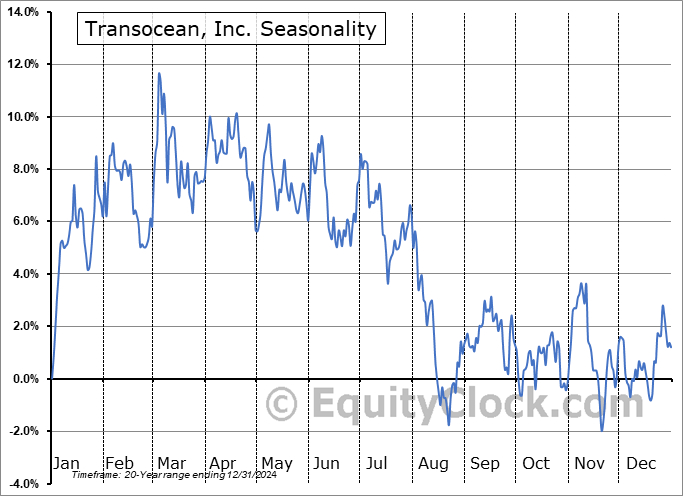

Seasonal charts of companies reporting earnings today:

S&P 500 Index

TSE Composite

| Sponsored By... |

|