Stock Market Outlook for July 13, 2023

Precious metals and emerging markets: Our list of Accumulate candidates just got a boost from June’s CPI report.

*** Stocks highlighted are for information purposes only and should not be considered as advice to purchase or to sell mentioned securities. As always, the use of technical and fundamental analysis is encouraged in order to fine tune entry and exit points to average seasonal trends.

Stocks Entering Period of Seasonal Strength Today:

Subscribers – Click on the relevant link to view the full profile. Not a subscriber? Signup here.

United Parcel Service, Inc. (NYSE:UPS) Seasonal Chart

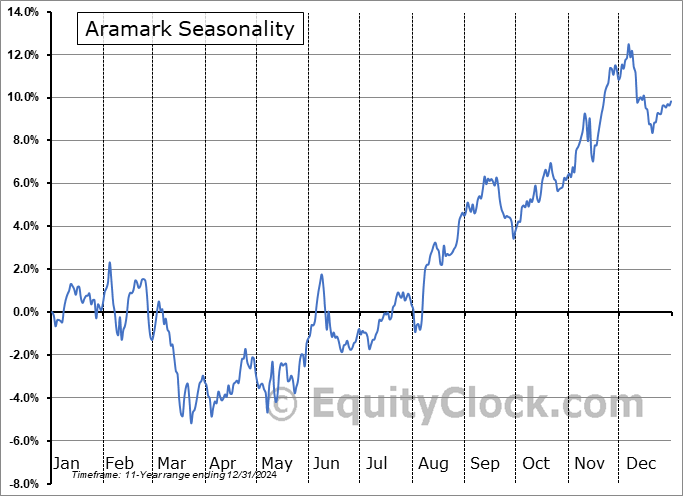

Aramark (NYSE:ARMK) Seasonal Chart

Ambarella, Inc. (NASD:AMBA) Seasonal Chart

CDW Corp. (NASD:CDW) Seasonal Chart

A-Mark Precious Metals, Inc. (NASD:AMRK) Seasonal Chart

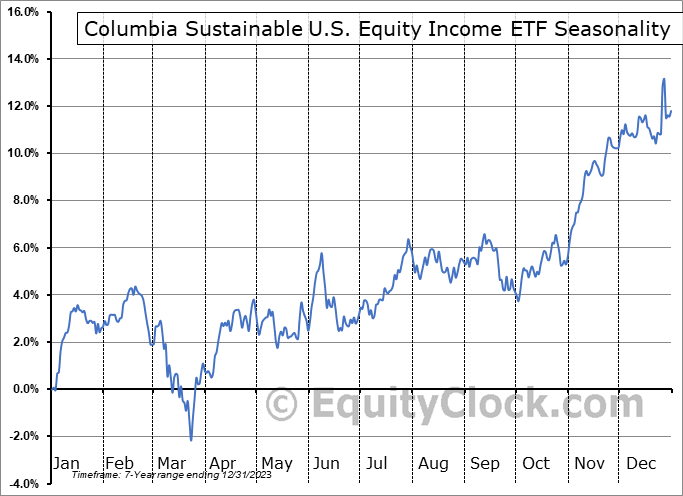

Columbia Sustainable U.S. Equity Income ETF (AMEX:ESGS) Seasonal Chart

The Markets

Stocks jumped to new 52-week highs on Wednesday following a softer than expected read of inflationary pressures in the economy. The S&P 500 Index closed higher by just less than three-quarters of one percent, plotting an upside gap at 4450 and offsetting the downside gap charted last week that resulted in speculation of an island reversal pattern. Support for the benchmark remains firm at the rising 20-day moving average and the other moving averages continue to fan out in a bullish manner, presenting other hurdles below for the benchmark to shoot off of. Momentum indicators are showing similar bullish characteristics above their middle lines, seemingly poised to cross into overbought territory again should this summer rally strength persist. The benchmark is knocking on the door of an important psychological level at 4500, but the calculated upside target that the breakout of the 400-point span between 3800 and 4200 suggests could see the benchmark reach 4600 before the summer rally concludes. Seasonally, the market remains support between the last week of June through the first few weeks of July, a phenomenon that is certainly underway.

Today, in our Market Outlook to subscribers, we discuss the following:

- US Consumer Price Index (CPI)

- Airlines

- Precious Metals

- Emerging Markets

- New 52-week lows for Total Assets on the Fed’s balance sheet

Subscribers can look for this report in their inbox or by clicking on the following link and logging in: Market Outlook for July 13

Not signed up yet? Subscribe now to receive full access to all of the research and analysis that we publish.

Sentiment on Wednesday, as gauged by the put-call ratio, ended bullish, again, at 0.84.

Seasonal charts of companies reporting earnings today:

S&P 500 Index

TSE Composite

| Sponsored By... |

|