Stock Market Outlook for May 4, 2023

Despite a demand backdrop that remains upbeat and supply that is stable, the price of oil has broken down, diverging from the trend of seasonal norms heading through the spring.

*** Stocks highlighted are for information purposes only and should not be considered as advice to purchase or to sell mentioned securities. As always, the use of technical and fundamental analysis is encouraged in order to fine tune entry and exit points to average seasonal trends.

Stocks Entering Period of Seasonal Strength Today:

Subscribers – Click on the relevant link to view the full profile. Not a subscriber? Signup here.

TransDigm Group Inc. (NYSE:TDG) Seasonal Chart

Copart, Inc. (NASD:CPRT) Seasonal Chart

MSCI, Inc. (NYSE:MSCI) Seasonal Chart

Royal Gold, Inc. (NASD:RGLD) Seasonal Chart

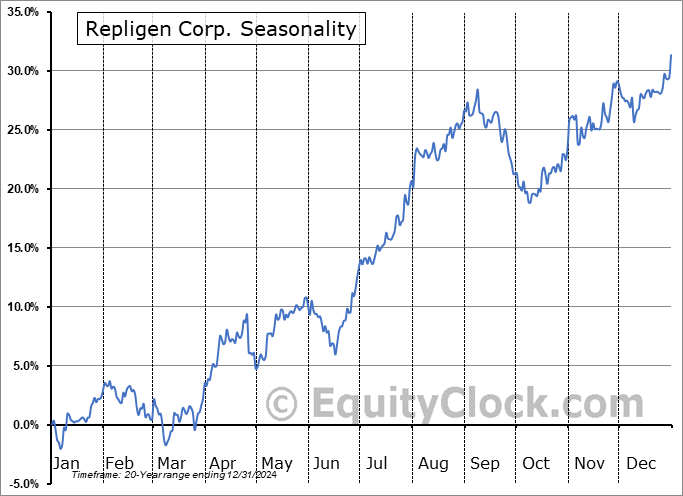

Repligen Corp. (NASD:RGEN) Seasonal Chart

The Markets

Stocks closed lower on Wednesday as investors digested comments from Fed Chair Jerome Powell following the two-day FOMC meeting. The S&P 500 Index ended down by seven-tenths of one percent, continuing to show rejection from the range of resistance between 4100 and 4200 that has capped upside momentum for the better part of the past year. Momentum indicators continue to roll over with MACD remaining on a sell signal that was triggered last week. While support continues to be implied around the congestion of major moving averages between 3950 and 4050, the market and the economy are providing a more compelling argument to place a heavier weight on overhead resistance than the potential level of support below. A break below the December low is still view as required to confirm a negative intermediate-term path, one that would see a return of that sustained negative trajectory that was observed through the first three-quarters of last year. The rotation away from core-cyclical segments of the market and the adoption of safe-havens (gold and treasury bonds) already expresses a risk-averse market, one that has greater downside risks than upside potential, at least for now.

Today, in our Market Outlook to subscribers, we discuss the following:

- The rotation away from core-cyclical sectors

- Double-top resistance for our core equity allocation and the action that we are taking

- VIX remaining around 16-month lows as its period of seasonal strength gets underway

- US Vehicle Sales and the Automobile industry index

- Weekly energy petroleum status and the technical backdrop to the energy commodity

Subscribers can look for this report in their inbox or by clicking on the following link and logging in: Market Outlook for May 4

Not signed up yet? Subscribe now to receive full access to all of the research and analysis that we publish.

Sentiment on Wednesday, as gauged by the put-call ratio, ended bearish at 1.13.

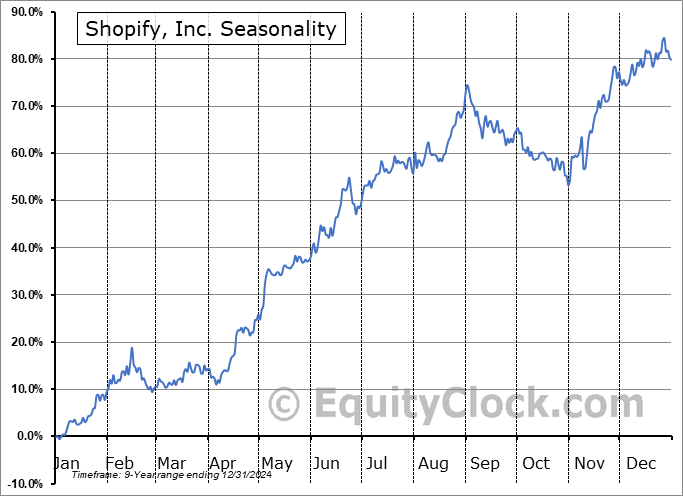

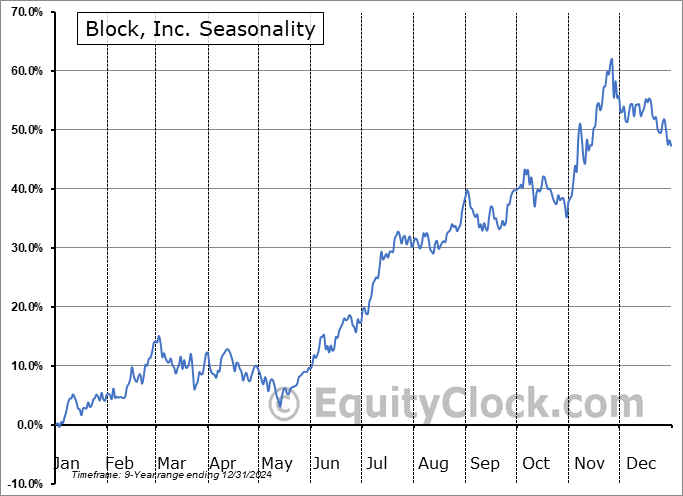

Seasonal charts of companies reporting earnings today:

S&P 500 Index

TSE Composite

| Sponsored By... |

|