Stock Market Outlook for April 18, 2023

Manufacturer sentiment in the New York region showed a shocking and abrupt rebound for April, raising questions as to how imminent an economic recession may be.

*** Stocks highlighted are for information purposes only and should not be considered as advice to purchase or to sell mentioned securities. As always, the use of technical and fundamental analysis is encouraged in order to fine tune entry and exit points to average seasonal trends.

Stocks Entering Period of Seasonal Strength Today:

Subscribers – Click on the relevant link to view the full profile. Not a subscriber? Signup here.

SiteOne Landscape Supply, Inc. (NYSE:SITE) Seasonal Chart

Barclays ETN+ Shiller CAPE Index ETN (AMEX:CAPE) Seasonal Chart

HealthEquity, Inc. (NASD:HQY) Seasonal Chart

Johnson & Johnson (NYSE:JNJ) Seasonal Chart

ServiceNow, Inc. (NYSE:NOW) Seasonal Chart

Northwest Pipe Co. (NASD:NWPX) Seasonal Chart

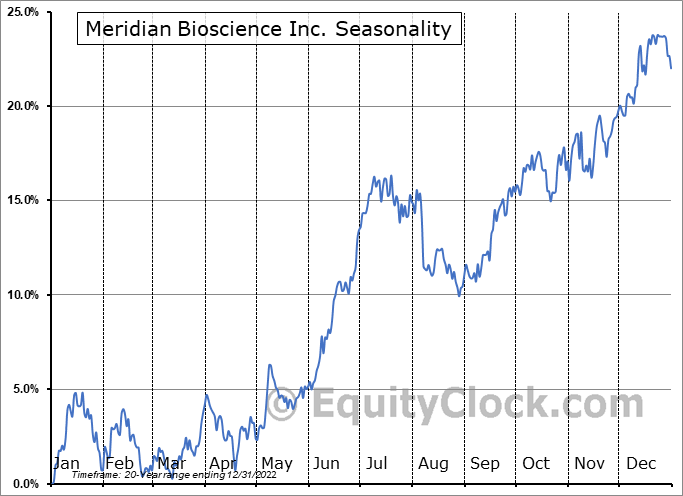

Meridian Bioscience Inc. (NASD:VIVO) Seasonal Chart

The Markets

Stocks drifted higher to start the week as market participants anticipate an upbeat earnings season now that the bar has been lowered amidst talk of recession over the past few months. The S&P 500 Index closed higher by a third of one percent, remaining within the range of resistance between 4100 and 4200. Momentum continues to struggle as investors wait for a catalyst to fuel a break, one way or the other. Major moving averages are gradually developing a positive slope, attempting to move beyond the declining trajectory of the past year. The confluence of major moving averages can be seen between 3950 to 4050, providing a point of short-term support below as the market nears the seasonal transition point from risk-on to risk-off plays.

Today, in our Market Outlook to subscribers, we discuss the following:

- Empire State Manufacturing Index

- REITs

- Upgrades and downgrades in this week’s chart books

- The overarching theme that remains prevalent across the charts

- Upside exhaustion in the price of Gold

Subscribers can look for this report in their inbox or by clicking on the following link and logging in: Market Outlook for April 18

Not signed up yet? Subscribe now to receive full access to all of the research and analysis that we publish.

Want to know which areas of the market to buy or sell? Our Weekly Chart Books have just been updated, providing a clear Accumulate, Avoid, or Neutral rating for currencies, cryptocurrencies, commodities, broad markets, and subsectors/industries of the market. Subscribers can login and click on the relevant links to access.

- Currencies

- Cryptocurrencies

- Commodities

- Major Benchmarks

- Sub-sectors / Industries

- ETFs: Bonds | Commodities | Equity Markets | Industries | Sectors

Subscribe now.

Sentiment on Monday, according to the put-call ratio, ended bearish at 1.08.

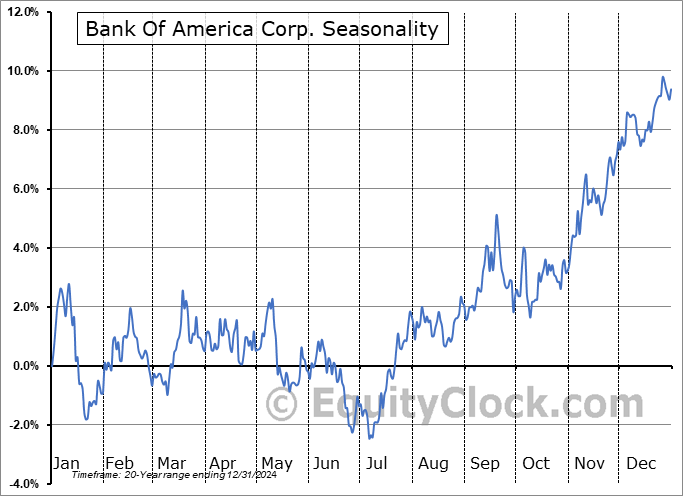

Seasonal charts of companies reporting earnings today:

S&P 500 Index

TSE Composite

| Sponsored By... |

|