Stock Market Outlook for March 2, 2023

*** Stocks highlighted are for information purposes only and should not be considered as advice to purchase or to sell mentioned securities. As always, the use of technical and fundamental analysis is encouraged in order to fine tune entry and exit points to average seasonal trends.

Stocks Entering Period of Seasonal Strength Today:

Subscribers – Click on the relevant link to view the full profile. Not a subscriber? Signup here.

iShares Core MSCI Europe ETF (AMEX:IEUR) Seasonal Chart

BMO Global Consumer Staples Hedged to CAD Index ETF (TSE:STPL.TO) Seasonal Chart

Ascent Industries Co. (NASD:ACNT) Seasonal Chart

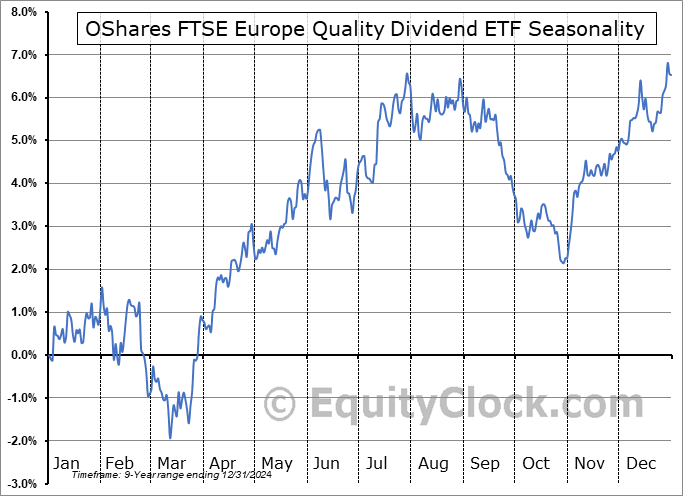

OShares FTSE Europe Quality Dividend ETF (AMEX:OEUR) Seasonal Chart

SPDR S&P Dividend ETF (NYSE:SDY) Seasonal Chart

SPDR Dow Jones Global Real Estate ETF (NYSE:RWO) Seasonal Chart

iShares MSCI International Developed Momentum Factor ETF (AMEX:IMTM) Seasonal Chart

DTE Energy Co. (NYSE:DTE) Seasonal Chart

Fidelity MSCI Utilities Index ETF (AMEX:FUTY) Seasonal Chart

BMO Covered Call Utilities ETF (TSE:ZWU.TO) Seasonal Chart

CoStar Group, Inc. (NASD:CSGP) Seasonal Chart

Cousins Properties, Inc. (NYSE:CUZ) Seasonal Chart

Camden Property Trust (NYSE:CPT) Seasonal Chart

Firstenergy Corp. (NYSE:FE) Seasonal Chart

The Markets

Stocks struggled in the first session of March as the cost of borrowing jumped higher amidst an ongoing repricing in the bond market following stronger than expected economic datapoints for the month of January. The S&P 500 Index ended lower by around half of one percent, slipping back below the 50-day moving average and reaching towards the still declining 200-day moving average. So far, this long-term variable hurdle that was broken as resistance in the middle of January is remaining unviolated as a point of potential support and, if this is sustained, it would send a strong signal to the market. Traditionally, it is well known on Wall Street that nothing good happens below the 200-day moving average and if you can merely avoid periods when price is below this threshold, you can perform very well in investment portfolios. Confirmation of support at this long-term hurdle would start to pull up on the negative slope and help to solidify a backstop to this market for a sustainable trade higher in prices into the spring. For now, the trend of the market in the short-term, as gauged by the declining 20-day moving average, is still negative and momentum indicators remain on a sell signal, as triggered by the bearish MACD crossover two and a half weeks ago. We’ll be watching the reaction of the market closely around these major moving averages and, until then, a neutral bias remains warranted.

Today, in our Market Outlook to subscribers, we discuss the following:

- The rise of yields towards some important psychological levels and the narrowing of spreads at the shorter-end of the curve

- The downfall of yield sensitive sectors and how to play this side of the market through the months ahead

- US International Trade

- Above average trajectory of construction spending and how to be “constructive” in the industry within portfolios

Subscribers can look for this report in their inbox or by clicking on the following link and logging in: Market Outlook for March 2

Not signed up yet? Subscribe now to receive full access to all of the research and analysis that we publish.

Just released…

Our 102-page monthly report for March is out, providing you with everything that you need to know for the month(s) ahead.

Highlights in this report include:

- Equity market tendencies in the month of March

- The decline in global central bank liquidity has taken a pause

- Elevated use of the Fed’s Repo facility gives future ammunition to the market

- Bears betting on an earnings recession to take down stocks, but not all companies are on a declining path

- Abnormally mild winter temperatures supporting the labor market early in 2023

- Weather and evolving seasonality significant factors behind early year strength in retail sales

- Abnormally mild winter weather fuels strength in industrial production, but an abnormal decline in utility production

- Manufacturers highly pessimistic of economic activity moving forward

- Waning business and consumer demand burdening shipping activity

- Baltic Dry Index down 90% from its pandemic peak

- Inflation problem in the economy has not gone away

- A dip in consumer loans to start the year

- The shift of the trend of delinquencies

- Major benchmarks struggling at last year’s breakdown points

- Dollar and Yields still key to the direction of stocks

- Break of the declining trend of the Volatility Index (VIX)

- Our list of all segments of the market to either Accumulate or Avoid, along with relevant ETFs

- Positioning for the months ahead

- Sector Reviews and Ratings

- Stocks that have Frequently Gained in the Month of March

- Notable Stocks and ETFs Entering their Period of Strength in March

Subscribers can look for this report in their inbox or via the report archive.

Not subscribed yet? Signup now to receive this and other reports that we publish on either a daily or monthly basis, providing insight on how to position your portfolio according to our three pronged approach.

Sentiment on Wednesday, as gauged by the put-call ratio, ended bearish at 1.14.

Seasonal charts of companies reporting earnings today:

S&P 500 Index

TSE Composite

| Sponsored By... |

|