Stock Market Outlook for February 7, 2023

*** Stocks highlighted are for information purposes only and should not be considered as advice to purchase or to sell mentioned securities. As always, the use of technical and fundamental analysis is encouraged in order to fine tune entry and exit points to average seasonal trends.

Stocks Entering Period of Seasonal Strength Today:

Subscribers – Click on the relevant link to view the full profile. Not a subscriber? Signup here.

General Mills Inc. (NYSE:GIS) Seasonal Chart

GSK Plc (NYSE:GSK) Seasonal Chart

Clean Harbors, Inc. (NYSE:CLH) Seasonal Chart

NuVasive, Inc. (NASD:NUVA) Seasonal Chart

Companias Cervecerias (NYSE:CCU) Seasonal Chart

International Seaways, Inc. (NYSE:INSW) Seasonal Chart

The Markets

Stocks slipped on Monday as rate fears following January’s stronger than average payroll report had investors trimming risk in investment portfolios. The S&P 500 Index slipped by six-tenths of one percent, reaching back to test the recent breakout point at 4100. The large-cap benchmark continues to provide encouraging evidence that it is progressing beyond the declining path of the past year as bearish sentiment gets washed out and levels of former resistance turn into support. But while recent breakouts are a good solid step to reversing this negative trajectory, the more enticing opportunity to become outright accumulators of domestic equities over a sustainable timeframe is when a path of higher-highs and higher-lows, supported by 50-week moving averages, becomes defined. For now, a neutral bias remains desired, but there are still plenty of areas where we can take more of a directional bet, either bullish or bearish (see our weekly chart books for further insight).

Today, in our Market Outlook to subscribers, we discuss the following:

- Hourly look at the large-cap benchmark

- The correlation between rates and the dollar on stocks and when to expect that correlation to break

- Ratings changes in this week’s chart books

- US Vehicle Sales

- Investor Sentiment

Subscribers can look for this report in their inbox or by clicking on the following link and logging in: Market Outlook for February 7

Not signed up yet? Subscribe now to receive full access to all of the research and analysis that we publish.

Want to know which areas of the market to buy or sell? Our Weekly Chart Books have just been updated, providing a clear Accumulate, Avoid, or Neutral rating for currencies, cryptocurrencies, commodities, broad markets, and subsectors/industries of the market. Subscribers can login and click on the relevant links to access.

- Currencies

- Cryptocurrencies

- Commodities

- Major Benchmarks

- Sub-sectors / Industries

- ETFs: Bonds | Commodities | Equity Markets | Industries | Sectors

Subscribe now.

Sentiment on Monday, as gauged by the put-call ratio, ended bullish at 0.77.

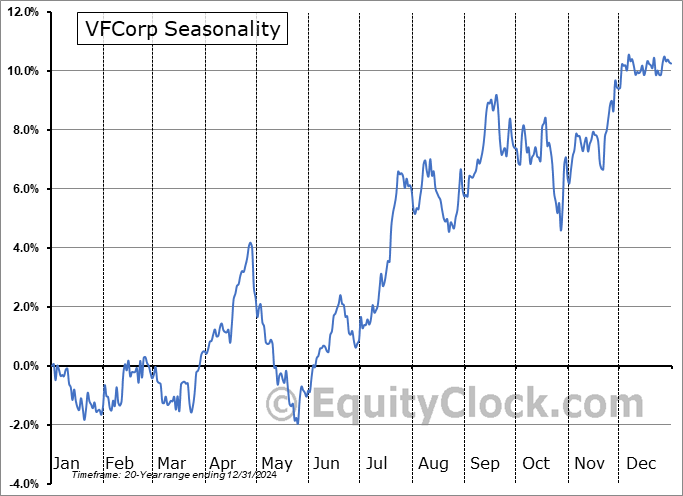

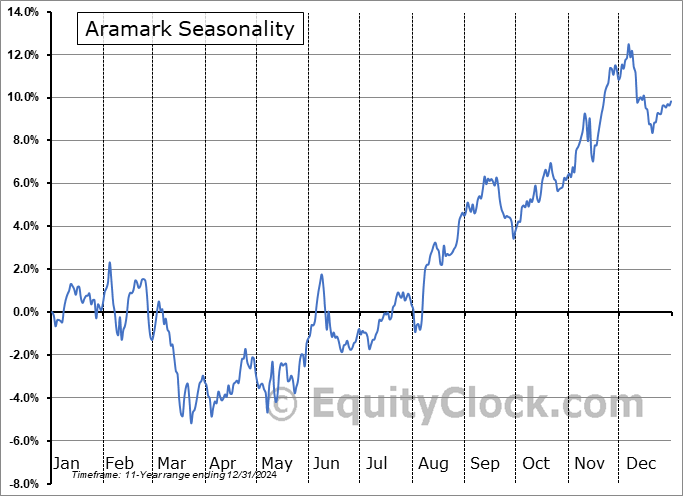

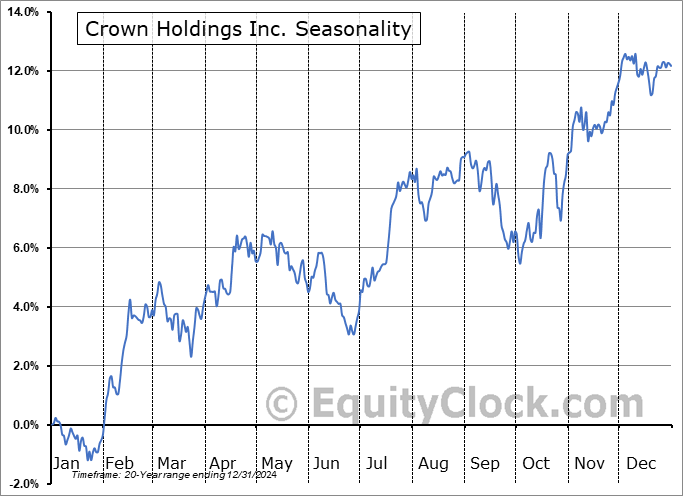

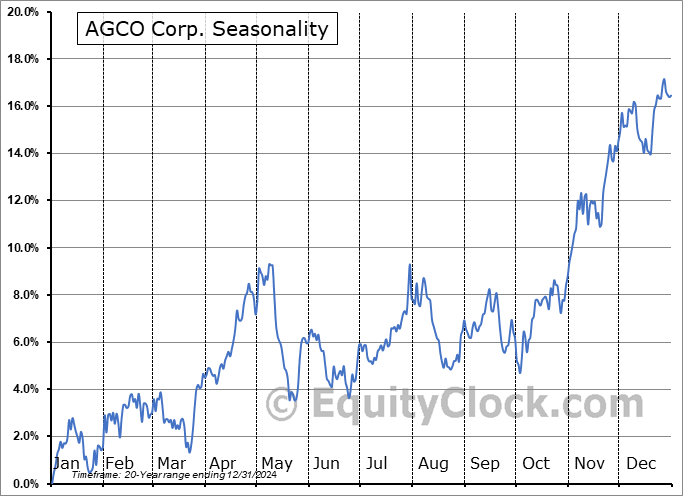

Seasonal charts of companies reporting earnings today:

S&P 500 Index

TSE Composite

| Sponsored By... |

|