Stock Market Outlook for January 23, 2023

*** Stocks highlighted are for information purposes only and should not be considered as advice to purchase or to sell mentioned securities. As always, the use of technical and fundamental analysis is encouraged in order to fine tune entry and exit points to average seasonal trends.

Stocks Entering Period of Seasonal Strength Today:

Subscribers – Click on the relevant link to view the full profile. Not a subscriber? Signup here.

Advanced Micro Devices, Inc. (NASD:AMD) Seasonal Chart

Carpenter Tech Corp. (NYSE:CRS) Seasonal Chart

Invesco DB Commodity Index Tracking Fund (NYSE:DBC) Seasonal Chart

Tapestry, Inc. (NYSE:TPR) Seasonal Chart

Abbott Laboratories (NYSE:ABT) Seasonal Chart

Stella-Jones, Inc. (TSE:SJ.TO) Seasonal Chart

Canadian National Railway Co. (TSE:CNR.TO) Seasonal Chart

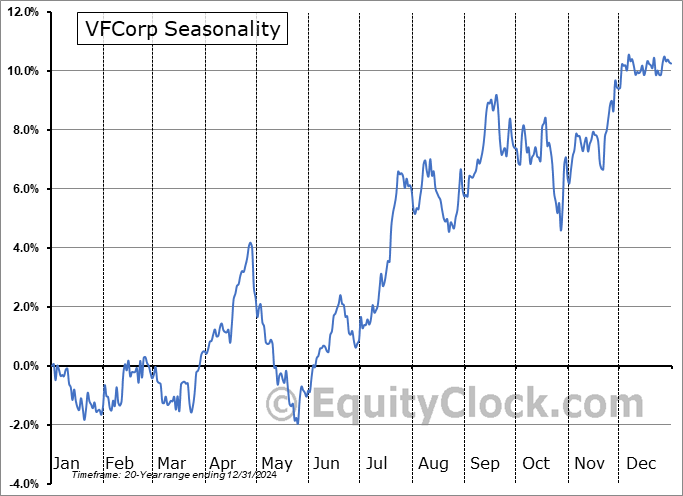

VFCorp (NYSE:VFC) Seasonal Chart

Flowserve Corp. (NYSE:FLS) Seasonal Chart

The Markets

Stocks rallied to end the week as investors cheered fourth quarter earnings from former FANG darling, Netflix (NFLX). The S&P 500 Index closed higher by 1.89%, bouncing from short-term support at the 20-day moving average and reaching back towards resistance at the 200-day moving average at 3,969. Declining trendline resistance at 4,000 remains the overarching threat overhead, although it would take a move above December’s highs of 4100 to start to suggest a shift of trend. The benchmark continues to hold above November’s upside gap between 3770 and 3860, providing a rather neutral view to the benchmark, one that is respecting both levels of support and resistance. Momentum indicators are emphasizing the same neutral bias with RSI and MACD holding around their middle lines. The prevailing declining trend of the benchmark continues to favour the bears, but, as has been mentioned in recent reports, it would take a move below 3877 to flip to an Avoid rating of the benchmark in our weekly chart books.

Today, in our Market Outlook to subscribers, we discuss the following:

- Weekly look at the large-cap benchmark

- The sustainability of the shift away from defensive equities and towards growth

- Review of the allocations in the Super Simple Seasonal Portfolio and insight on how to position in this market

- US Existing Home Sales

Subscribers can look for this report in their inbox or by clicking on the following link and logging in: Market Outlook for January 23

Not signed up yet? Subscribe now to receive full access to all of the research and analysis that we publish.

Sentiment on Friday, as gauged by the put-call ratio, ended slightly bullish at 0.88.

Seasonal charts of companies reporting earnings today:

S&P 500 Index

TSE Composite

| Sponsored By... |

|