Stock Market Outlook for October 25, 2022

The new 52-week high list of stocks has stopped falling, hinting of the conclusion of the near-term declining trend of the equity market.

*** Stocks highlighted are for information purposes only and should not be considered as advice to purchase or to sell mentioned securities. As always, the use of technical and fundamental analysis is encouraged in order to fine tune entry and exit points to average seasonal trends.

Stocks Entering Period of Seasonal Strength Today:

Subscribers – Click on the relevant link to view the full profile. Not a subscriber? Signup here.

China Eastern Airlines (NYSE:CEA) Seasonal Chart

Esperion Therapeutics, Inc. (NASD:ESPR) Seasonal Chart

L3Harris Technologies Inc. (NYSE:LHX) Seasonal Chart

Five9 Inc. (NASD:FIVN) Seasonal Chart

First Trust NYSE Arca Biotechnology Index Fund (NYSE:FBT) Seasonal Chart

SPDR Russell 1000 Momentum Focus ETF (AMEX:ONEO) Seasonal Chart

Hormel Foods Corp. (NYSE:HRL) Seasonal Chart

Eli Lilly & Co. (NYSE:LLY) Seasonal Chart

Omnicom Group, Inc. (NYSE:OMC) Seasonal Chart

Foot Locker, Inc. (NYSE:FL) Seasonal Chart

Kaiser Aluminum Corp. (NASD:KALU) Seasonal Chart

Blackrock, Inc. (NYSE:BLK) Seasonal Chart

Comcast Corp. (NASD:CMCSA) Seasonal Chart

Hibbett Sports Inc. (NASD:HIBB) Seasonal Chart

The Markets

Stocks rallied to open the week as ongoing hints of a peak in yields and a peak in the dollar is sending investors back into the equity market. The S&P 500 Index gained 1.19%, moving back towards the early October high and increasingly carving out a short-term bottoming pattern around this summer’s lows. Support continues to be pegged at the 20-day moving average, while resistance is viewed at the declining 50-day moving average, a level that, until broken, provides a hurdle to sell into in order to reduce equity exposure. Positive momentum divergences versus price remain intact, something that alerted us to the waning selling pressures prior to this multi-day rally attempt. The best six months for stocks running from November to April is directly ahead, a logical time, at least through the end of the year, to see stability return to the market following a treacherous year for price.

Today, in our Market Outlook to subscribers, we discuss the following:

- The declining trend of 52-week highs for stocks has been broken

- Notable ratings changes in this week’s chart books: Find out what has been upgraded to Accumulate this week and the ETFs that you can use to gain exposure

- The currency market

Subscribers can look for this report in their inbox or by clicking on the following link and logging in: Market Outlook for October 25

Not signed up yet? Subscribe now to receive full access to all of the research and analysis that we publish.

Want to know which areas of the market to buy or sell? Our Weekly Chart Books have just been updated, providing a clear Accumulate, Avoid, or Neutral rating for currencies, cryptocurrencies, commodities, broad markets, and subsectors/industries of the market. Subscribers can login and click on the relevant links to access.

Subscribe now.

Sentiment on Monday, as gauged by the put-call ratio, ended neutral at 0.96.

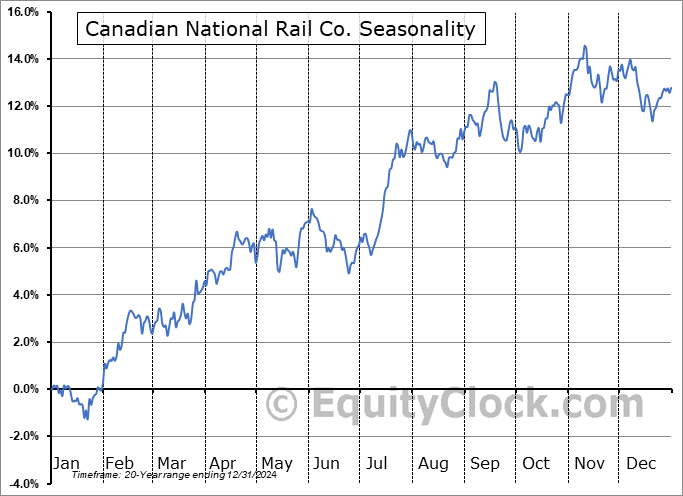

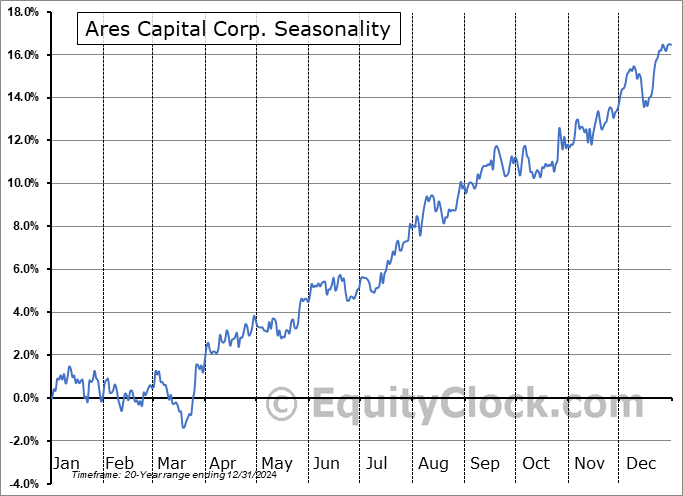

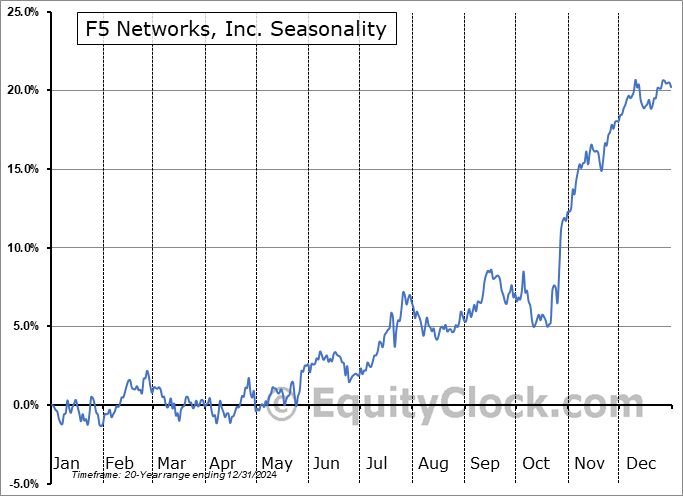

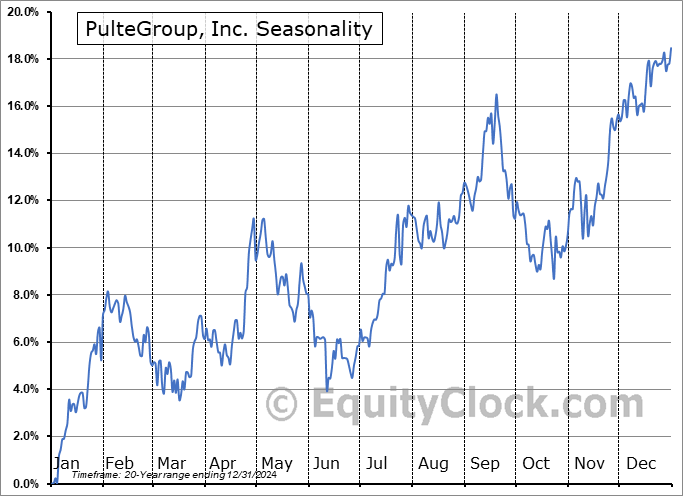

Seasonal charts of companies reporting earnings today:

S&P 500 Index

TSE Composite

| Sponsored By... |

|