Stock Market Outlook for August 3, 2022

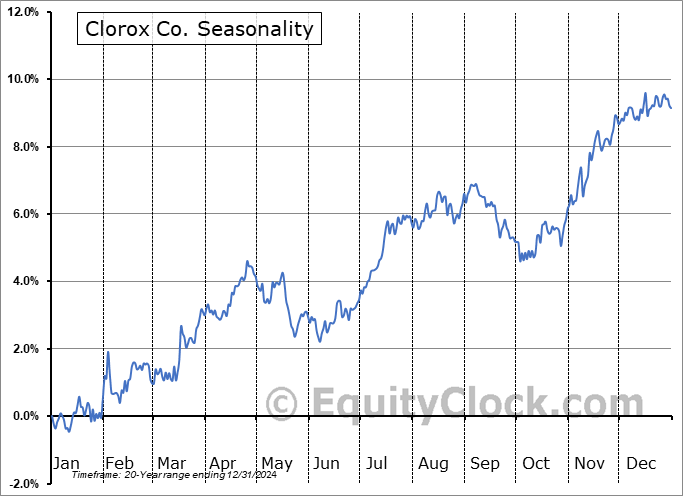

Defensive groups in the Staples and Utilities sectors popping up as areas to Accumulate in this week’s chart books.

*** Stocks highlighted are for information purposes only and should not be considered as advice to purchase or to sell mentioned securities. As always, the use of technical and fundamental analysis is encouraged in order to fine tune entry and exit points to average seasonal trends.

Stocks Entering Period of Seasonal Strength Today:

Subscribers – Click on the relevant link to view the full profile. Not a subscriber? Signup here.

McDonalds Corp. (NYSE:MCD) Seasonal Chart

First Financial Bancorp. (NASD:FFBC) Seasonal Chart

John Bean Technologies Corp. (NYSE:JBT) Seasonal Chart

Carriage Services, Inc. (NYSE:CSV) Seasonal Chart

iShares North American Tech-Software ETF (NYSE:IGV) Seasonal Chart

The Markets

Stocks closed mildly lower on Tuesday as reaction to important levels of horizontal resistance start to become realized. The S&P 500 Index closed down by two-thirds of one percent, starting to carve out a level of short-term resistance at 4145, below horizontal resistance of the May highs around 4170. The 50-day moving average, indicative of the direction of the intermediate-term trend and one that we tend to place heavy emphasis on in our intermediate-term trading process, is increasingly curling higher, relinquishing the negative trajectory that has been seen of it all year. The variable hurdle now sits at 3929, or around 4% below present levels, presenting the near-term risk. The risk-reward in the short-term is still viewed as being unfavourable given the stretched condition that has evolved over the past week; a consolidation/retracement back to the variable hurdle is seen as desired before looking to increase risk (stocks) in portfolios further for our forecasted back half of the year strength in the market. A correction back to the intermediate hurdle in the weeks ahead could establish a significant head-and-shoulders bottoming pattern, the neckline to which would be pegged at the aforementioned May highs around 4170. The most important characteristic of this bullish setup has yet to be charted, which is a higher-low above the mid-June bottom. Shorter-term momentum indicators are rolling over from overbought territory, suggesting the exhaustion of the recent near-term move higher.

Want to know which areas of the market to buy or sell? Our Weekly Chart Books have just been updated, providing a clear Accumulate, Avoid, or Neutral rating for currencies, cryptocurrencies, commodities, broad markets, and subsectors/industries of the market. Subscribers can login and click on the relevant links to access.

Subscribe now.

Today, in our Market Outlook to subscribers, we discuss the following:

- Notable ratings changes in this week’s chart books: Find out what has been upgraded to Accumulate this week

- Job Openings and Labor Turnover Survey (JOLTS)

- US Construction Spending

- Investor sentiment

Subscribers can look for this report in their inbox or by clicking on the following link and logging in: Market Outlook for August 3

Not signed up yet? Subscribe now to receive full access to all of the research and analysis that we publish.

Sentiment on Tuesday, as gauged by the put-call ratio, ended neutral at 1.00.

Seasonal charts of companies reporting earnings today:

S&P 500 Index

TSE Composite

| Sponsored By... |

|