Stock Market Outlook for June 17, 2022

Looking out for the cues that would suggest selling exhaustion in order to flip back to risk-on in the equity market.

*** Stocks highlighted are for information purposes only and should not be considered as advice to purchase or to sell mentioned securities. As always, the use of technical and fundamental analysis is encouraged in order to fine tune entry and exit points to average seasonal trends.

Stocks Entering Period of Seasonal Strength Today:

Subscribers – Click on the relevant link to view the full profile. Not a subscriber? Signup here.

Alcoa Corp. (NYSE:AA) Seasonal Chart

Natus Medical, Inc. (NASD:NTUS) Seasonal Chart

Aberdeen Standard Physical Precious Metals Basket Shares ETF (NYSE:GLTR) Seasonal Chart

ProShares UltraShort Oil & Gas (NYSE:DUG) Seasonal Chart

Packaging Corp Of America (NYSE:PKG) Seasonal Chart

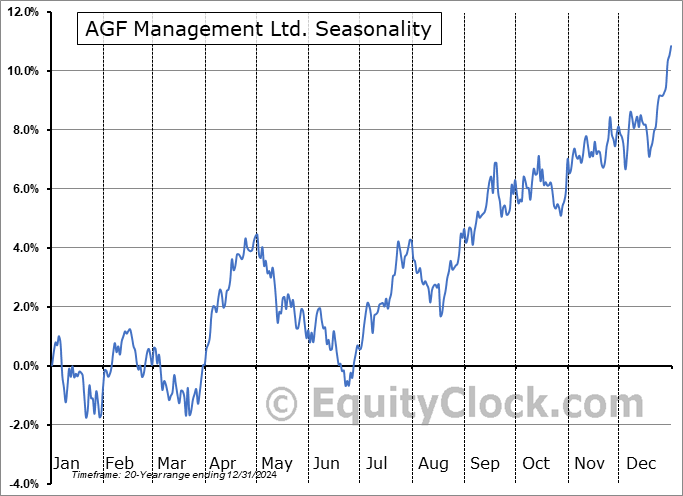

AGF Management Ltd. (TSE:AGF/B.TO) Seasonal Chart

The Markets

Stocks took another leg lower on Thursday as a slew of negative economic data-points and ongoing reaction to the FOMC announcement on Wednesday had investors looking to shed further risk in portfolios. The S&P 500 Index dropped by 3.25%, breaking below declining trendline support that had been keeping the selloff orderly since the year began. Traditionally, the market moving from an orderly to disorderly decline as investors seek to aggressively get out of positions typically marks the beginning of the end to declining trends. Momentum indicators are reaching back towards oversold extremes with the Relative Strength Index on the verge of crossing below the 30-threshold that acts as the borderline for declaring an oversold state. It was the riskiest segment of the market that fuelled the decline with the consumer discretionary and energy sectors down around 5% on the day while the more defensive consumer staples sector was just marginally lower. Risk aversion is implied, however, for those that have staked their claim in some of the more defensive segments of the market are not feeling much comfort given the breakdown in many lower-beta bets (staples, utilities, REITs) in recent days. The price action resembles an investor base that just wants out, but this flood of selling is more likely to lead to a tradable low in stocks as downside exhaustion becomes realized. We are not there yet, but getting close.

Today, in our Market Outlook to subscribers, we discuss the following:

- Looking for cues to rotate back into risk (stocks)

- The sharp drop in the US Dollar Index

- Credit spreads reacting to levels around the recent highs

- Becoming hypervigilant of coincident indications to an economic recession: Weekly Jobless Claims

- US Housing Starts and questioning the data within

- Philadelphia Fed Manufacturing Survey

- 50-Day moving average of the put-call ratio reaching the upper end of its historical range

Subscribers can look for this report in their inbox or by clicking on the following link and logging in: Market Outlook for June 17

Not signed up yet? Subscribe now to receive full access to all of the research and analysis that we publish.

Sentiment on Thursday, as gauged by the put-call ratio, ended bearish at 1.25.

Seasonal charts of companies reporting earnings today:

S&P 500 Index

TSE Composite

| Sponsored By... |

|