Stock Market Outlook for May 27, 2022

Margin debt has fallen by the most through the first four months of the year since 2001 as investors deleverage their portfolios.

*** Stocks highlighted are for information purposes only and should not be considered as advice to purchase or to sell mentioned securities. As always, the use of technical and fundamental analysis is encouraged in order to fine tune entry and exit points to average seasonal trends.

Stocks Entering Period of Seasonal Strength Today:

Subscribers – Click on the relevant link to view the full profile. Not a subscriber? Signup here.

American Water Works Co. Inc. (NYSE:AWK) Seasonal Chart

Resmed, Inc. (NYSE:RMD) Seasonal Chart

MTY Food Group Inc. (TSE:MTY.TO) Seasonal Chart

iShares Gold Bullion ETF (TSE:CGL.TO) Seasonal Chart

Amgen, Inc. (NASD:AMGN) Seasonal Chart

Coeur Mining Inc (NYSE:CDE) Seasonal Chart

VanEck Vectors Junior Gold Miners ETF (NYSE:GDXJ) Seasonal Chart

iShares International Treasury Bond ETF (NASD:IGOV) Seasonal Chart

The Markets

Stocks rebounded sharply on Thursday as an alleviation of concerns pertaining to the consumer sent investors back into some of the beaten down consumer discretionary names in the market. The S&P 500 Index gained around 2%, closing above its 20-day moving average for the first time since the start of April. Declining trendline support, currently just below 3800, continues to provide the propping point for this upside rebound, while resistance around major moving averages at the 50 and 200-day moving averages (4280 and 4450) remaining threatening overhead. Momentum indicators continue to curl higher after trading down to near oversold levels in recent weeks and MACD remains on a buy signal that was triggered on Wednesday. A rebound in the market through the last week of the month is exactly what we have been anticipating, but while short-term waning selling pressures in recent weeks have been conducive to a rebound attempt, a more defined bottom may be required in order to fuel a more sustainable move higher, something that we are looking out for in the month ahead. In the meantime, we are positioned to take advantage of the near-term rally, but we are also holding onto those long-duration bonds, which have derived a trend of outperformance versus stocks in recent weeks, indicative of buying demand.

Today, in our Market Outlook to subscribers, we discuss the following:

- The ongoing trend of outperformance in the bond market

- Our forecasted May 25th Technology buy date

- The change in Margin Debt in investor accounts

- Weekly Jobless Claims

- Canadian Retail Sales and the stocks of the retailers

Subscribe now and we’ll send this outlook to you.

Soon to be released…

We are busy placing the finishing touches on our monthly report for June, providing you with everything that you need to know for the month ahead. Subscribers can look for this report in their inbox on Friday.

Not subscribed yet? Signup now and we’ll send this and other reports to you to get you started with our service.

Sentiment on Thursday, as gauged by the put-call ratio, ended slightly bullish at 0.92.

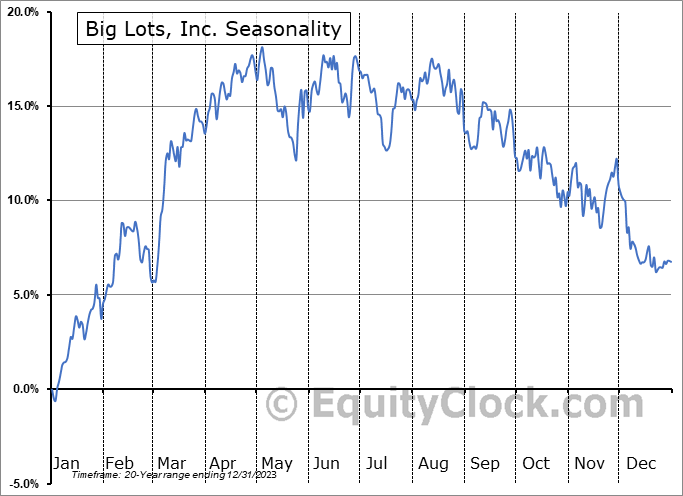

Seasonal charts of companies reporting earnings today:

S&P 500 Index

TSE Composite

| Sponsored By... |

|