Stock Market Outlook for April 6, 2022

The 10-year US treasury yield is breaking above a massive band of resistance, now on its way to 3%, a level that the equity market is likely to take issue with.

*** Stocks highlighted are for information purposes only and should not be considered as advice to purchase or to sell mentioned securities. As always, the use of technical and fundamental analysis is encouraged in order to fine tune entry and exit points to average seasonal trends.

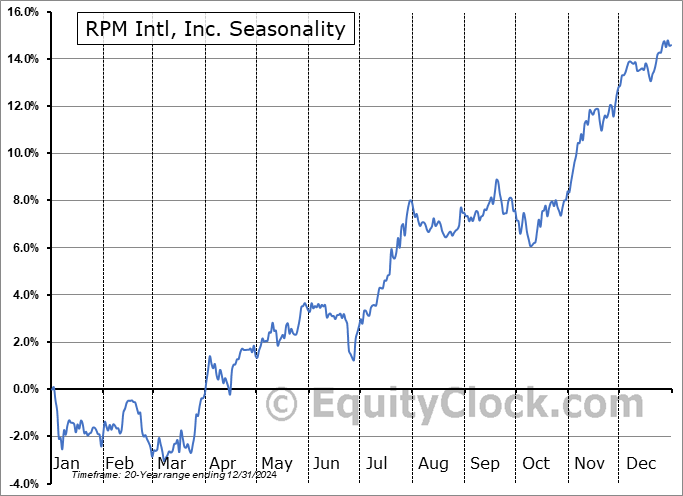

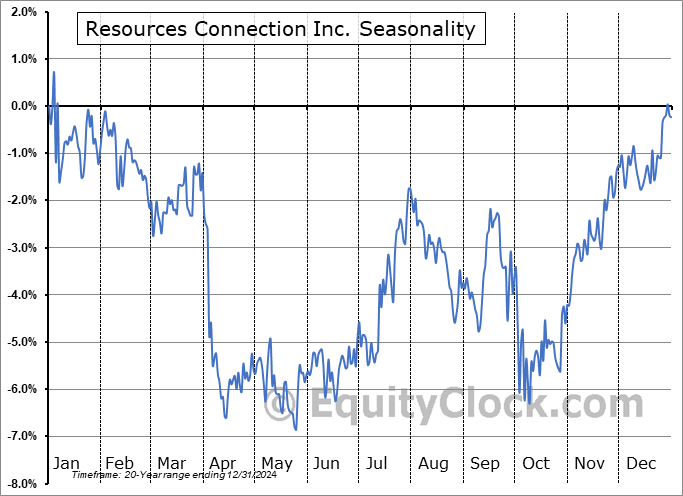

Stocks Entering Period of Seasonal Strength Today:

Subscribers – Click on the relevant link to view the full profile. Not a subscriber? Signup here.

Macerich Co. (NYSE:MAC) Seasonal Chart

U.S. Physical Therapy, Inc. (NYSE:USPH) Seasonal Chart

BMO High Yield US Corporate Bond Hedged To CAD Index ETF (TSE:ZHY.TO) Seasonal Chart

Boyd Group Income Fund (TSE:BYD.TO) Seasonal Chart

The Markets

The equity market readopted a defensive posture following Monday’s rally amidst headlines that the Fed may take a more aggressive approach to tighten monetary policy in order to combat soaring inflationary pressures. The S&P 500 Index shed 1.26%, erasing the prior session’s gain and causing investors to reconsider exposure to high multiple growth stocks. Consolidation above the recently broken 200-day moving average is still implied, for now, however, a close below recent minor horizontal support at 4530 has been confirmed. Momentum indicators, while maintaining rising trends following the breakout above declining trendline resistance in the middle of March, continue to roll over as the near-term buying demand stalls. As we have been reporting, we are on the lookout to become much more conservative in the portfolio for the back half of the second quarter (May/June), but we don’t feel that we have reached the point yet where retrenching is appropriate. The market will be reluctant to adopt a bearish bias ahead of and/or during the release of earnings, which will start to flow in the coming week. Consolidation around moving averages, as is presently being witnessed, is likely until earnings themselves cause the catalyst to either fuel a breakdown or breakout as we near our timeframe to seek to become more conservative in May and June.

Today, in our Market Outlook to subscribers, we discuss the following:

- The breakout in the cost of borrowing above a band of resistance

- Pursuing those quasi cyclical/defensive sectors amidst the uncertain market backdrop

- Ratio of Consumer Discretionary versus Consumer Staples

- Total Vehicle Sales in the US and the stocks of auto makers

- Canada Merchandise Trade

- The Canadian Dollar

Subscribe now and we’ll send this outlook to you.

Sentiment on Tuesday, as gauged by the put-call ratio, ended close to neutral at 0.95.

Seasonal charts of companies reporting earnings today:

S&P 500 Index

TSE Composite

| Sponsored By... |

|