Stock Market Outlook for February 25, 2022

Value over growth trade coming to an end?

*** Stocks highlighted are for information purposes only and should not be considered as advice to purchase or to sell mentioned securities. As always, the use of technical and fundamental analysis is encouraged in order to fine tune entry and exit points to average seasonal trends.

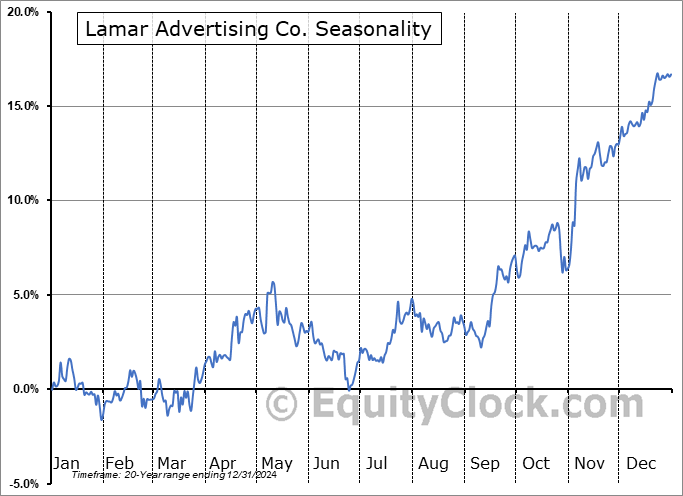

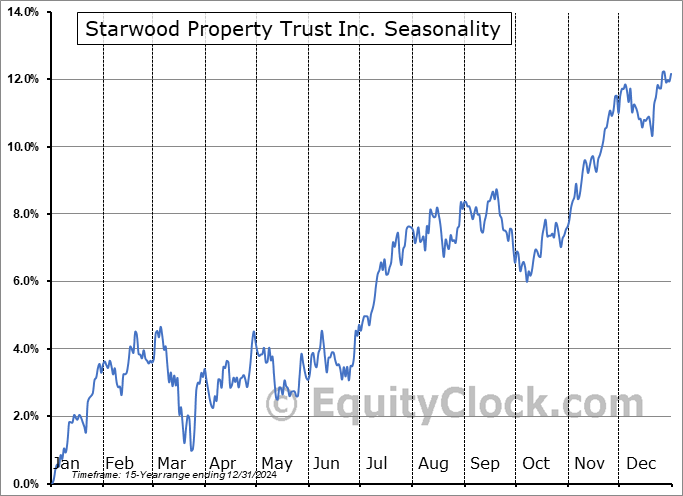

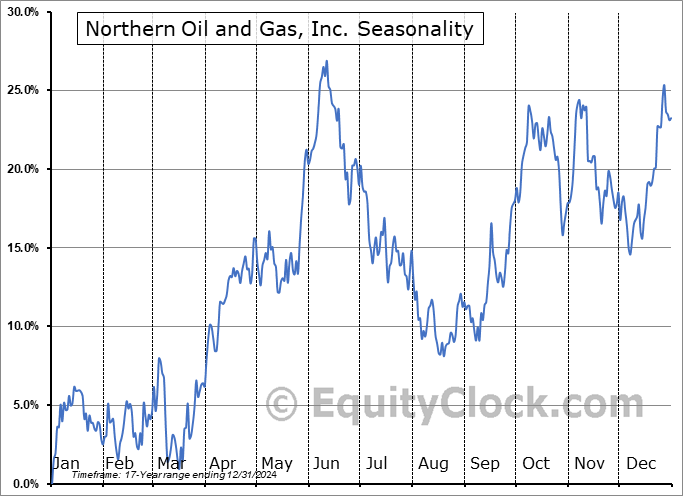

Stocks Entering Period of Seasonal Strength Today:

Subscribers – Click on the relevant link to view the full profile. Not a subscriber? Signup here.

Leggett & Platt, Inc. (NYSE:LEG) Seasonal Chart

Williams Cos., Inc. (NYSE:WMB) Seasonal Chart

Dollarama Inc. (TSE:DOL.TO) Seasonal Chart

AirBoss of America Corp. (TSE:BOS.TO) Seasonal Chart

Linde plc (NYSE:LIN) Seasonal Chart

Vanguard Communication Services ETF (NYSE:VOX) Seasonal Chart

Global X Health & Wellness Thematic ETF (NASD:BFIT) Seasonal Chart

The Markets

Stocks in the US largely shook off news that Russia had invaded Ukraine, which sent markets around the globe into panic. The S&P 500 Index closed with a gain of 1.50%, reversing the sharp early session decline that saw a loss over 2% in the moments following the opening bell. The only other time in the history of the S&P 500 Index that the benchmark has shed 100 points by the lows of the session and managed to close positive on the day was just last month on January 24th, which resulted in a tradable low that carried the benchmark higher through the first week of February. Evidence of selling exhaustion is implied. The benchmark managed to close mildly above previously broken support at 4280, which marks the neckline to a head-and –shoulder topping pattern. Ongoing reaction to this hurdle will be critical as this is still a market that is showing greater respect for levels of resistance than levels of support and Thursday’s action does not really change that. Momentum indicators continue to show characteristics of a bearish trend, although there is a potential that they may chart a higher-low above the January low, providing a positive divergence. This would be a bullish revelation to hint that a short-term low has been achieved and that the strength of the equity market that we have been expecting of March and April is underway.

Today, in our Market Outlook to subscribers, we discuss the following:

- Tradable potential in technology oriented ETFs; the unwind of value over growth.

- Lack of hallmarks of a washout day

- Weekly petroleum status and the reversal of energy sector stocks

- Weekly jobless claims and the health of the labor market

- US New Home Sales and home building stocks

Subscribe now and we’ll send this outlook to you.

Sentiment on Thursday, as gauged by the put-call ratio, ended slightly bearish at 1.02.

Seasonal charts of companies reporting earnings today:

S&P 500 Index

TSE Composite

| Sponsored By... |

|