Stock Market Outlook for January 25, 2022

Major flip in the market on Monday as investors reach back towards risk following the selloff in recent weeks.

Â

Â

Â

*** Stocks highlighted are for information purposes only and should not be considered as advice to purchase or to sell mentioned securities.  As always, the use of technical and fundamental analysis is encouraged in order to fine tune entry and exit points to average seasonal trends.

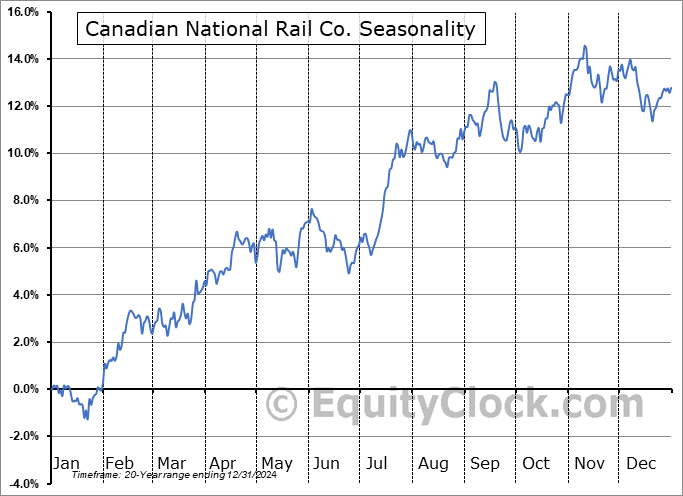

Stocks Entering Period of Seasonal Strength Today:

Subscribers – Click on the relevant link to view the full profile. Not a subscriber? Signup here.

Hartford Financial Services Group, Inc. (NYSE:HIG) Seasonal Chart

Aon Corp. (NYSE:AON) Seasonal Chart

S&P Global Inc. (NYSE:SPGI) Seasonal Chart

Greenbrier Cos, Inc. (NYSE:GBX) Seasonal Chart

United States 12 Month Oil Fund, LP (NYSE:USL) Seasonal Chart

iShares Core High Dividend ETF (NYSE:HDV) Seasonal Chart

Â

Â

Â

The Markets

A massive reversal on Wall Street saw major equity benchmarks close higher after losses reaching around 4% recorded at the lows of Monday’s session. The S&P 500 Index closed with a gain of three-tenths of one percent as traders start to nibble around the edges. At the lows of the day, the decline had achieved the classic definition of a correction, meaning a pullback of 10% or more. The Relative Strength Index (RSI) sits firmly in oversold territory below 30, currently testing the lowest levels since March of 2020 amidst the pandemic plunge. The market has become significantly stretched to the downside over the short to intermediate-term and the sustainability of the downward trajectory is questionable. We are currently looking at the weakest January for the equity market on record and it would be very difficult to keep this pace going without a catalyst to justify it. We have been very conservative in our equity allocation for the month of January and we are ready to put cash and cash equivalents back to work.

Today, in our Market Outlook to subscribers, we discuss the following:

- Investors reaching back towards risk

- The change being enacted in the Super Simple Seasonal Portfolio

- Tracking the spread of COVID against seasonal norms for respiratory illness season

- Notable upgrades and downgrades in this week’s chart books: Find out what has been upgraded to Accumulate this week and what segments of the market have the best charts currently

- Investor sentiment

Subscribe now and we’ll send this outlook to you.

Want to know which areas of the market to buy or sell? Our Weekly Chart Books have just been updated, providing a clear Accumulate, Avoid, or Neutral rating for currencies, cryptocurrencies, commodities, broad markets, and subsectors/industries of the market. Subscribers can login and click on the relevant links to access.

Subscribe now.

Sentiment on Monday, as gauged by the put-call ratio, ended overly bearish at 1.22.Â

Â

Â

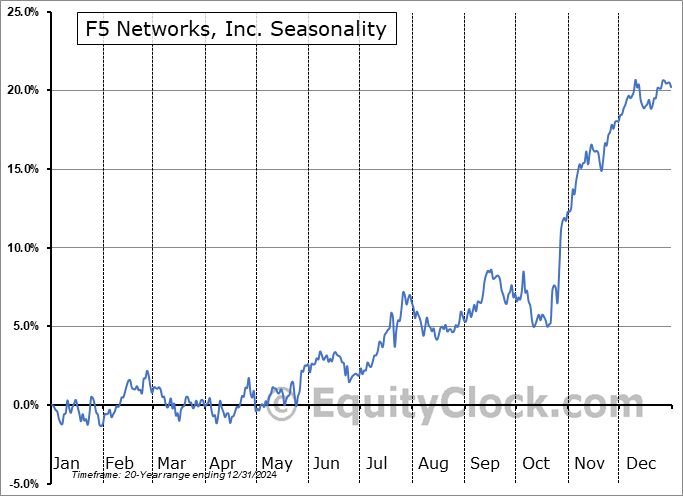

Seasonal charts of companies reporting earnings today:

Â

Â

S&P 500 Index

Â

Â

TSE Composite

| Sponsored By... |

|