Stock Market Outlook for January 18, 2022

Buying exhaustion in the equity market and consumer economy becoming apparent.

Â

Â

Â

*** Stocks highlighted are for information purposes only and should not be considered as advice to purchase or to sell mentioned securities.  As always, the use of technical and fundamental analysis is encouraged in order to fine tune entry and exit points to average seasonal trends.

Stocks Entering Period of Seasonal Strength Today:

Subscribers – Click on the relevant link to view the full profile. Not a subscriber? Signup here.

Aluminum Corp. of China (NYSE:ACH) Seasonal Chart

ProShares Large Cap Core Plus (NYSE:CSM) Seasonal Chart

SPDR S&P Retail ETF (NYSE:XRT) Seasonal Chart

Penumbra, Inc. (NYSE:PEN) Seasonal Chart

CNX Resources Corp. (NYSE:CNX) Seasonal Chart

Foot Locker, Inc. (NYSE:FL) Seasonal Chart

NextEra Energy Inc. (NYSE:NEE) Seasonal Chart

Canadian Pacific Railway (TSE:CP.TO) Seasonal Chart

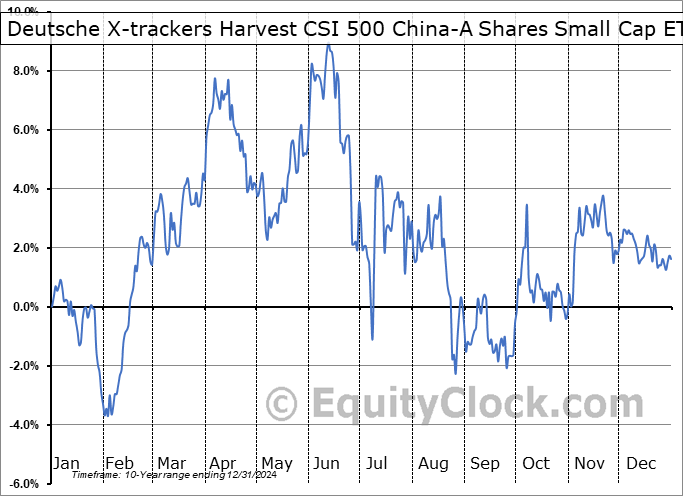

Deutsche X-trackers Harvest CSI 500 China-A Shares Small Cap ETF (AMEX:ASHS) Seasonal Chart

Absolute Software Corp. (NASD:ABST) Seasonal Chart

Communication Services Select Sector SPDR Fund (NYSE:XLC) Seasonal Chart

Â

Â

The Markets

Stocks closed mixed on Friday as investors tried to shake off weakness that has been bubbling up in the technology sector in the past couple of weeks. The S&P 500 Index closed higher by just less than a tenth of one percent, closing below its 50-day moving average. Resistance around 4720 remains intact and rising trendline support around 4650 was pierced intraday, but by the closing bell each hurdle remained unviolated. Momentum indicators continue to negatively diverge from price, which has hinted of waning buying demand for the past couple of weeks. The normal digestion of the gains derived through the fourth quarter continues to play out.

Today, in our Market Outlook to subscribers, we discuss the following:

- The topping pattern that is being derived on the S&P 500 Index

- Waning buying demand as the large-cap benchmark struggles to maintain support at the 20-week moving average

- US Retail Sales: What is driving activity and the shifting habits of consumer holiday shopping

- Retail stocks as we enter the strongest time of the year for the market group

- US Industrial Production

- The consolidation of Semiconductor stocks

Subscribe now and we’ll send this outlook to you.

Sentiment on Friday, as gauged by the put-call ratio, ended bearish at 1.11.Â

Â

Â

Â

Â

Seasonal charts of companies reporting earnings today:

Â

Â

S&P 500 Index

Â

Â

TSE Composite

| Sponsored By... |

|