Stock Market Outlook for January 13, 2022

While gains in the energy sector have been robust to start the year, today we question the pace of gains as we observe signs that demand for gasoline has fallen sharply since Christmas.

Â

Â

Â

*** Stocks highlighted are for information purposes only and should not be considered as advice to purchase or to sell mentioned securities.  As always, the use of technical and fundamental analysis is encouraged in order to fine tune entry and exit points to average seasonal trends.

Stocks Entering Period of Seasonal Strength Today:

Subscribers – Click on the relevant link to view the full profile. Not a subscriber? Signup here.

Canadian Natural Resources Ltd. (TSE:CNQ.TO) Seasonal Chart

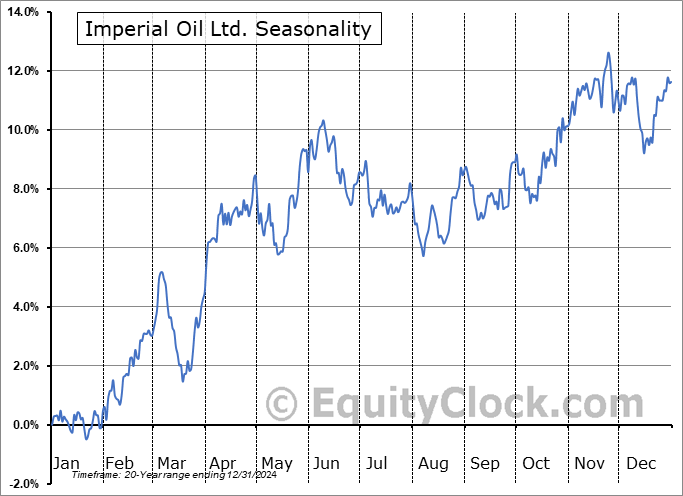

Imperial Oil Ltd. (TSE:IMO.TO) Seasonal Chart

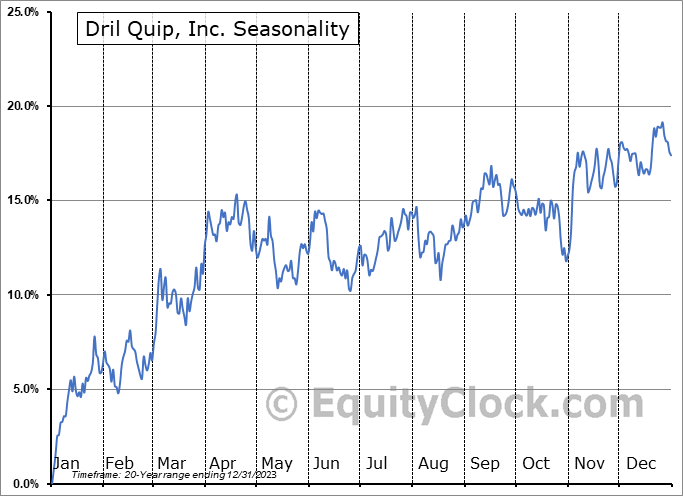

Dril Quip, Inc. (NYSE:DRQ) Seasonal Chart

Kirby Corp. (NYSE:KEX) Seasonal Chart

Monolithic Power Systems, Inc. (NASD:MPWR) Seasonal Chart

Invesco S&P 500 Quality ETF (AMEX:SPHQ) Seasonal Chart

Â

Â

Â

The Markets

Stocks drifted higher on Wednesday as investors digested a report of consumer inflation in the US. The S&P 500 Index drifted higher by just less than three-tenths of one percent, charting a rather indecisive doji candlestick. Previous resistance around 4720 continues to be tested as the market contends with the apex of a narrowing range range between the horizontal hurdle and rising trendline support. The benchmark has made intraday attempts to break each of the hurdles in recent days, but nothing has definitively stuck by the closing bell. Momentum indicators continue to negatively diverge from price, hinting of waning buying demand. While there is not enough technically nor fundamentally to suggest a negative (bearish) bias of the market, there is certainly nothing to suggest reason to be aggressive on the bullish side either. Keeping a certain amount of powder dry under this circumstance remains appropriate.

Today, in our Market Outlook to subscribers, we discuss the following:

- US Consumer Price Index (CPI)

- The average performance of the S&P 500 around the first Fed rate hike over the past two decades

- The change in oil and gas inventories to start the year

- The drop in gasoline product supplied

- Price of Oil

- US Dollar Index back to levels of significant support

Subscribe now and we’ll send this outlook to you.

Sentiment on Wednesday, as gauged by the put-call ratio, ended bullish at 0.81.

Â

Â

Â

Seasonal charts of companies reporting earnings today:

Â

Â

S&P 500 Index

Â

Â

TSE Composite

| Sponsored By... |

|