Stock Market Outlook for January 5, 2022

The tailwind to the equity market during the Santa Claus rally period has shifted, which could mean a tougher period for stocks through the remainder of this month.

Â

Â

Â

*** Stocks highlighted are for information purposes only and should not be considered as advice to purchase or to sell mentioned securities.  As always, the use of technical and fundamental analysis is encouraged in order to fine tune entry and exit points to average seasonal trends.

Stocks Entering Period of Seasonal Strength Today:

Subscribers – Click on the relevant link to view the full profile. Not a subscriber? Signup here.

Chicago Rivet & Machine Co. (AMEX:CVR) Seasonal Chart

PayPal Holdings, Inc. (NASD:PYPL) Seasonal Chart

Alarm.com Holdings, Inc. (NASD:ALRM) Seasonal Chart

Crescent Point Energy Corp. (TSE:CPG.TO) Seasonal Chart

Smith AO Corp. (NYSE:AOS) Seasonal Chart

Coherent, Inc. (NASD:COHR) Seasonal Chart

Invesco Defensive Equity ETF (NYSE:DEF) Seasonal Chart

iShares Edge MSCI Minimum Volatility EAFE ETF (AMEX:EFAV) Seasonal Chart

Invesco CurrencyShares Swiss Franc Trust (NYSE:FXF) Seasonal Chart

SPDR S&P Software & Services ETF (NYSE:XSW) Seasonal Chart

ProShares VIX Mid-Term Futures ETF (NYSE:VIXM) Seasonal Chart

Â

Â

Â

The Markets

Stocks closed mixed on Tuesday as investors took their cues from gyrations in the bond market, which has seen rates surge in the past couple of sessions. The S&P 500 Index closed essentially unchanged after charting a record intraday high during the session. The price action has charted a doji (indecision) candlestick, a sign of hesitation in the short-term trend as the heart of the Santa Claus rally period comes to an end. Previous resistance at 4720 remains in a position of support, along with rising 20 and 50-day moving averages at 4710 and 4667, respectively. While momentum indicators continue to show characteristics of a bullish trend, evidence of waning upside strength can be picked out, including the ongoing struggle of advance-decline lines and lower levels of MACD and RSI compared to the previous market peak in November. Neither are threatening of an imminent collapse, but they are highlighting some strain, something that we have been expecting of the equity market beyond the Santa Claus rally period that concludes this week.

Today, in our Market Outlook to subscribers, we discuss the following:

- The downfall of Technology/NASDAQ Composite and when we will look for a more opportune time to pick up depressed names

- The breakdown of Shopify (SHOP)

- Treasury yields back to resistance

- Job Openings and Labor Turnover Survey: What the fundamental trends are indicating as to how we should position the portfolio

- REITs

- Seasonal strength in the US Dollar

Subscribe now and we’ll send this outlook to you.

Sentiment on Tuesday, as gauged by the put-call ratio, ended bullish at 0.81.

Â

Â

Â

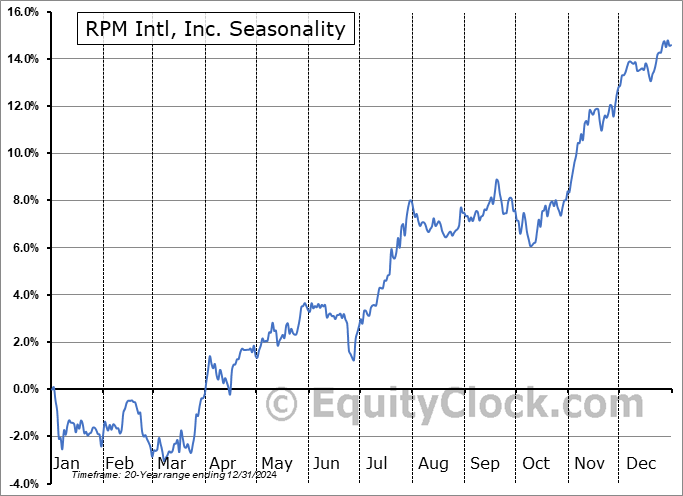

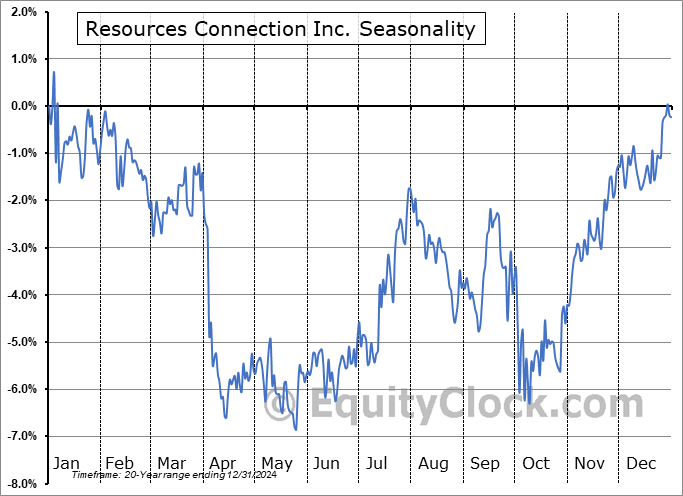

Seasonal charts of companies reporting earnings today:

Â

Â

S&P 500 Index

Â

Â

TSE Composite

| Sponsored By... |

|