Stock Market Outlook for November 18, 2021

The gyrations in the commodity market on Wednesday pose risk to one of our seasonal trades, but creates an opportunity in another.

Â

Â

Â

*** Stocks highlighted are for information purposes only and should not be considered as advice to purchase or to sell mentioned securities.  As always, the use of technical and fundamental analysis is encouraged in order to fine tune entry and exit points to average seasonal trends.

Stocks Entering Period of Seasonal Strength Today:

Subscribers – Click on the relevant link to view the full profile. Not a subscriber? Signup here.

Fluor Corp. (NYSE:FLR) Seasonal Chart

Atlantic Power Corp. (TSE:ATP.TO) Seasonal Chart

Exco Technologies Ltd. (TSE:XTC.TO) Seasonal Chart

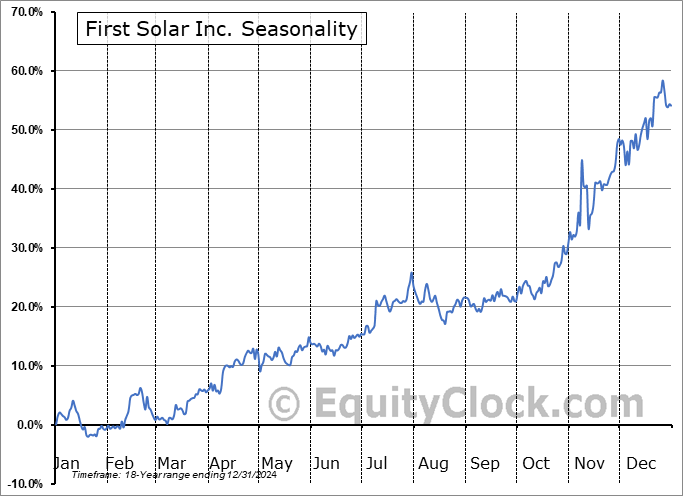

First Solar Inc. (NASD:FSLR) Seasonal Chart

MSCI, Inc. (NYSE:MSCI) Seasonal Chart

Darling Ingredients Inc. (NYSE:DAR) Seasonal Chart

CGI Inc. (NYSE:GIB) Seasonal Chart

iShares MSCI Israel Capped ETF (NYSE:EIS) Seasonal Chart

New Germany Fund (NYSE:GF) Seasonal Chart

iShares Russell Mid-Cap Value ETF (NYSE:IWS) Seasonal Chart

Pimco Corporate Opportunity (NYSE:PTY) Seasonal Chart

Â

Â

The Markets

Stocks closed mildly lower on Wednesday as the lacklustre performance attributed to this softer period of November continues. The S&P 500 Index slipped by just over a quarter of one percent, remaining just below the all-time peak that was charted during the first week of November. We will remain a broken record, highlighting support at 20 and 50-day moving averages, now at 4635 and 4502, respectively, as well as support at the lower limit of the previous rising range, now at 4650. Trendline resistance can continue to be pegged at 4750. This is still a market that is showing a positive trend across short, intermediate, and long-term timeframes and the consolidation over the past week and a half is normal and expected. The next uptick in stocks is typically realized during the week of the US Thanksgiving holiday, which is now just days away. So far, from a broad perspective, everything is playing out according to plan.

Today, in our Market Outlook to subscribers, we discuss the following:

- The drop in the price of Copper and Oil on Wednesday: The risk and the opportunity

- US Petroleum Inventories

- US Housing Starts and the strategy pertaining to the ETFs that derive exposure

- Canada CPI

Subscribe now and we’ll send this outlook to you.

Sentiment on Wednesday, as gauged by the put-call ratio, ended bullish at 0.81.

Â

Seasonal charts of companies reporting earnings today:

Â

Â

S&P 500 Index

Â

Â

TSE Composite

| Sponsored By... |

|